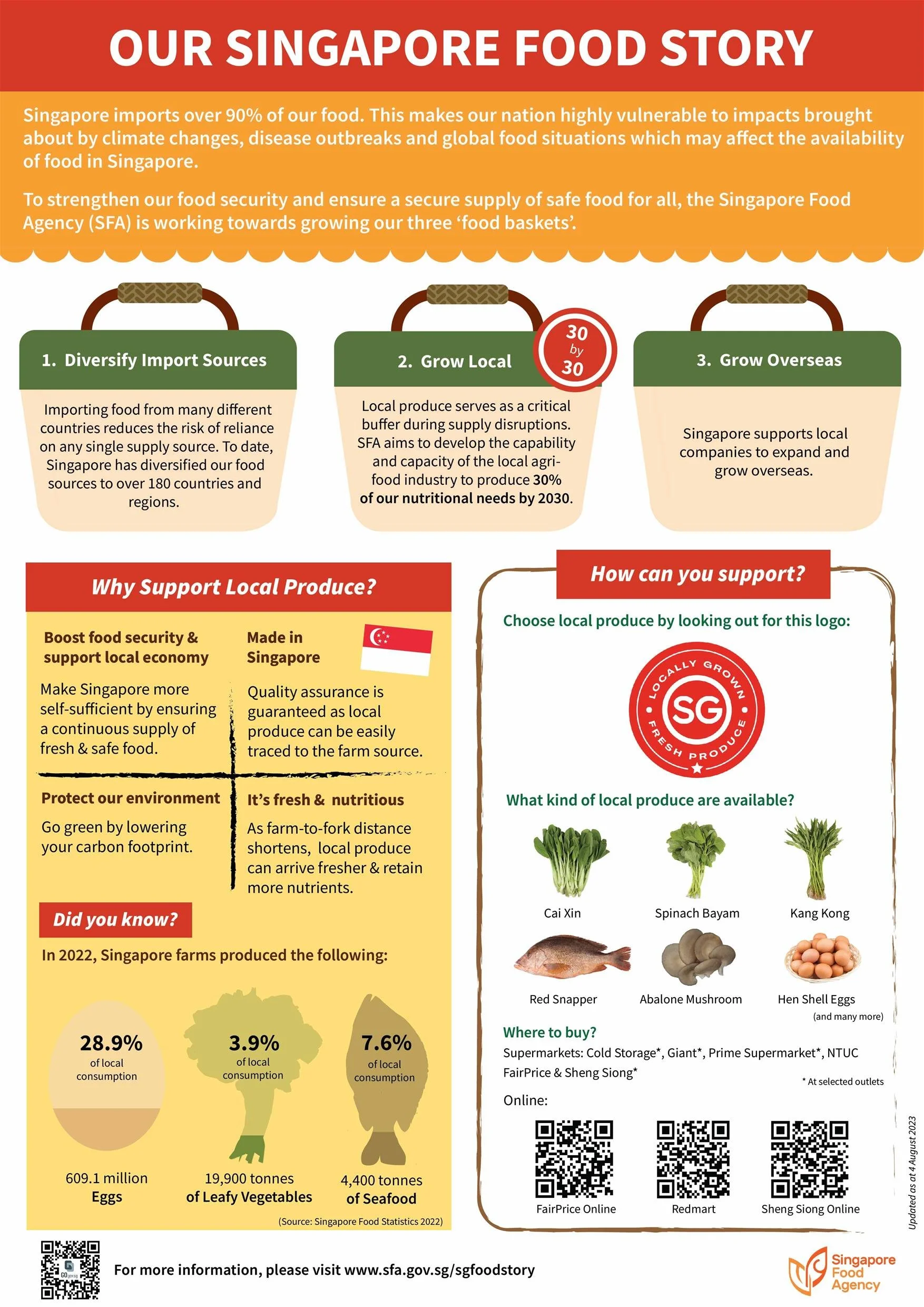

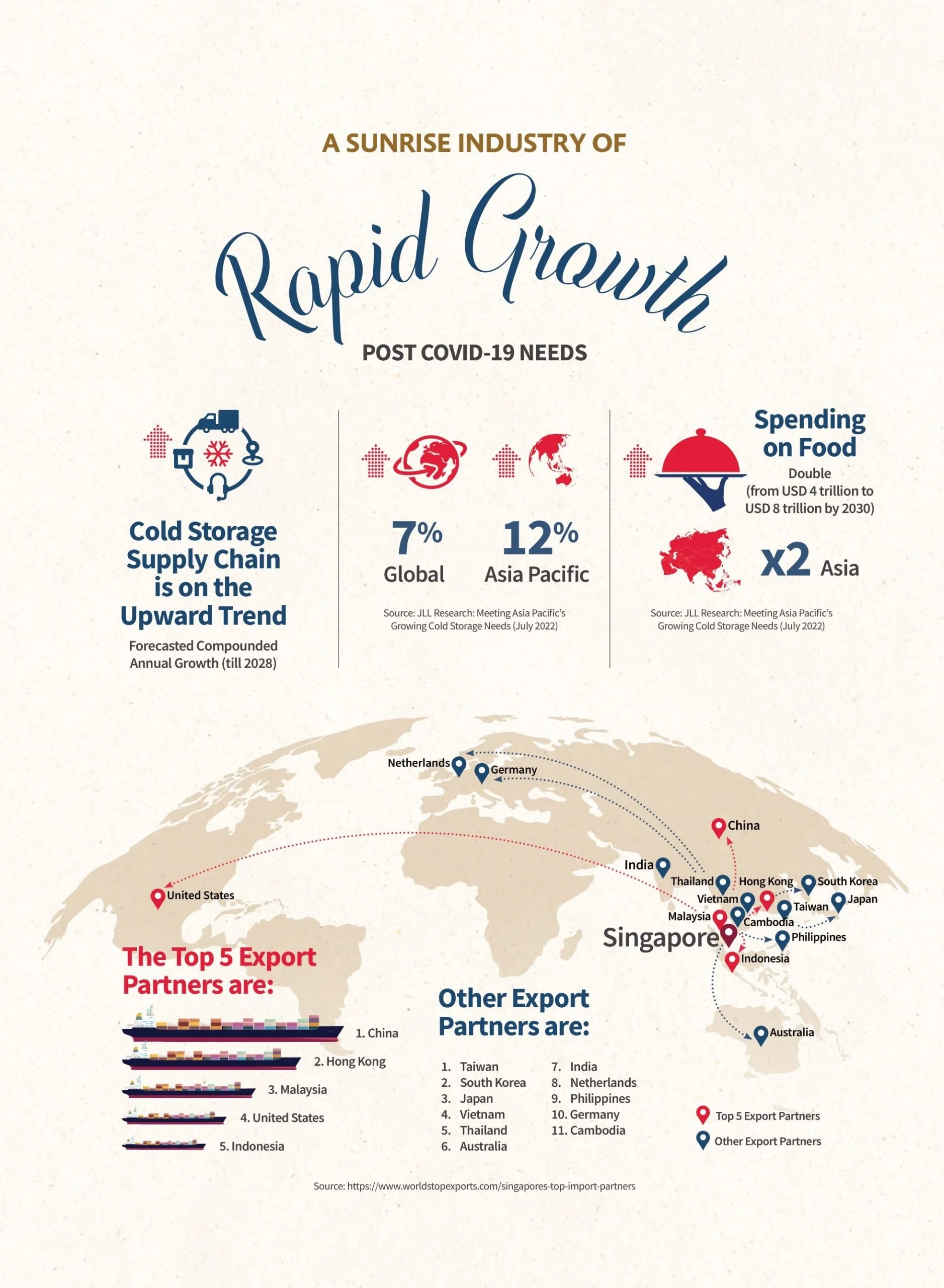

Investing in Singapore's food manufacturing sector presents a promising opportunity due to several strategic developments and supportive initiatives:

1. Government Initiatives and Industry Transformation

The Singaporean government has introduced the refreshed Food Manufacturing Industry Transformation Map (ITM) 2025, aiming to position Singapore as a trusted food and nutrition leader and a launchpad for quality brands into Asia. This initiative is expected to create approximately 2,500 new jobs in the sector, focusing on enhancing supply chain resilience and promoting sustainable practices.

2. Digitalization and Technological Advancements

To bolster productivity and innovation, the Infocomm Media Development Authority (IMDA) and Enterprise Singapore have launched the Food Manufacturing Industry Digital Plan (IDP). This plan provides a structured roadmap for SMEs to adopt digital solutions, aiming to benefit around 1,000 food manufacturers and over 50,000 workers.

3. Job Creation and Workforce Development

The sector is set to introduce over 2,500 new roles in the next five years, including positions like food biotechnologist, sustainability engineer, and automation engineer. This expansion reflects the industry's commitment to upskilling the workforce and embracing automation to meet evolving market demands.

4. Strategic Investments by Global Players

Major international companies are recognizing Singapore's strategic importance as a food manufacturing hub. For instance, Saudi Arabia's Salic has acquired a controlling stake in Singapore-based commodities trader Olam Agri, highlighting the city's role in global food supply chains.

5. Collaborative Economic Zones

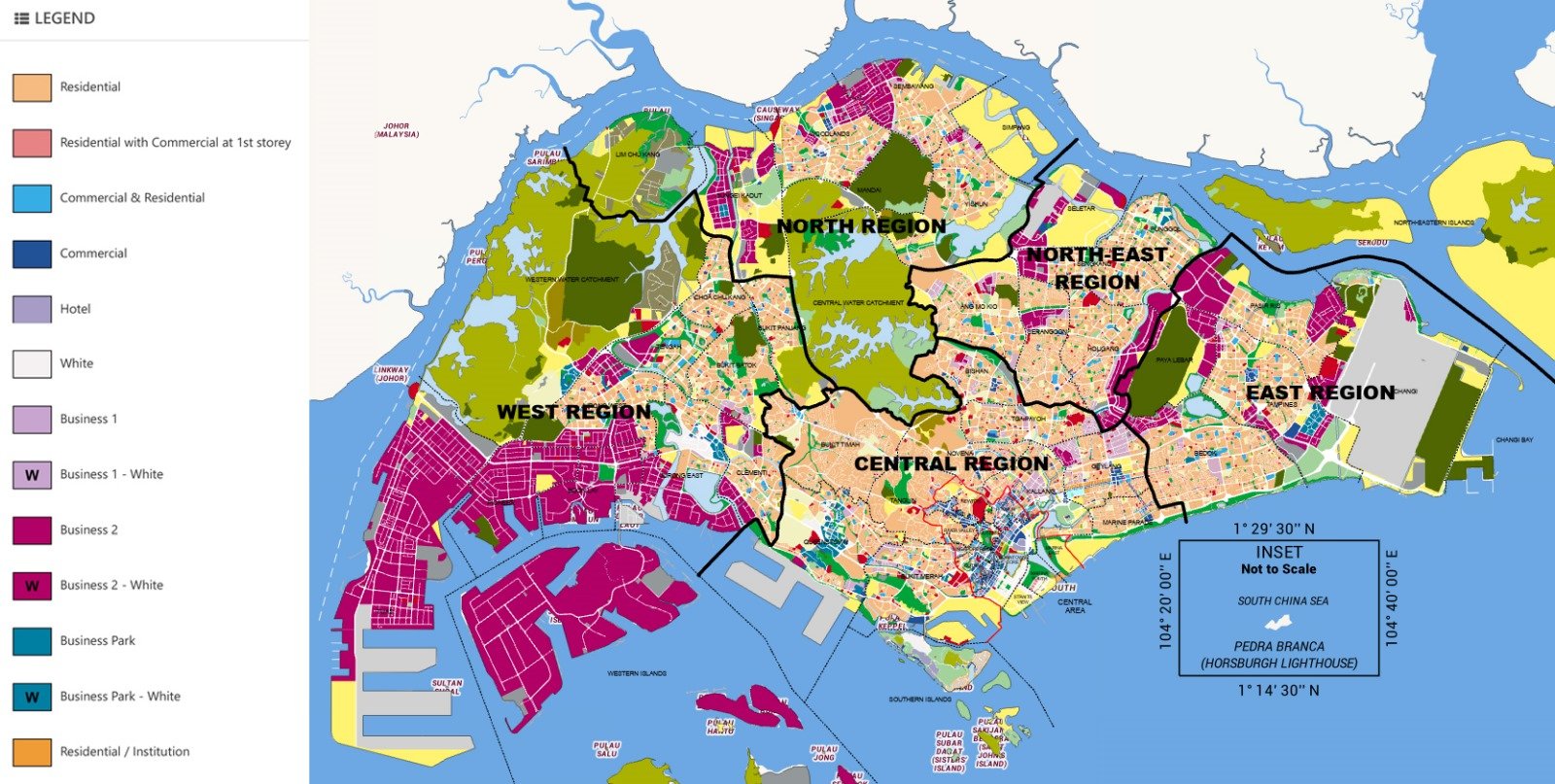

Singapore's collaboration with Malaysia to establish a special economic zone in Johor aims to enhance investment opportunities and streamline the movement of goods and people. This initiative is expected to attract high-value investments across various sectors, including food manufacturing, further bolstering the region's appeal to investors.

These developments underscore Singapore's strategic position as a leader in food manufacturing, offering investors a dynamic and supportive environment to capitalize on emerging opportunities.

Comparison of the 4 types of Properties.

Harrison Food

B1 Industrial - F&B ready

Freehold

Full Ownership

District 13

Tai Seng

5-min walk to Tai Seng MRT (Circle Line)

~1,722 - 2486 sqft

Food production, packaging, R&D

Annual Rental Income: $150K - $183K

Rental Yield: 4.5% – 5.49%

Capital Appreciation: ✅ Strong (Freehold + central fringe)

Residential Option: ❌ No

Foreign Ownership: ✅ Allowed

Manufacturing: ✅ Purpose-built for food production

Export: ✅ Eligible for SFA licensing

Foreign Workers: ✅ Eligible under industrial quota

Initial Outlay: Lowfr: $3,336,245

Purchase Price: S$3,336,245

Loan (80%): S$2,668,996

Downpayment (20%): S$667,249

Loan Tenure: 20 years

Interest Rate: 3.5% p.a.

Est Mortgage Payment: App S$15,500/m

HDB Shophouse

1st: Commercial

2nd: Residential

Leasehold (from 1980)

Reverts to state after 99 years

District 2

Everton Park/Tanjong Pagar/Telok Ayer

5–10 min walk to Outram Park / Tanjong Pagar / Telok Ayer MRT

~1,700 - 2000 sqft

Retail; take-away cafe, possible F&B with URA approval and proper renovation

Annual Rental Income: $78K - $100K

Rental Yield: 1.73% – 3.85%

Capital Appreciation: ⚠️ Moderate (Leasehold depreciation)

Residential Option: ✅ Yes (Staffs can stay upstairs)

Foreign Ownership: ❌ Restricted (requires HDB eligibility)

Manufacturing: ❌ Not permitted

Export: ❌ Not applicable

Foreign Workers: ❌ Restricted under HDB rules

Initial Outlay: Lowest$2,600,000 - $4,500,000

Purchase Price: S$2,600,000

Loan (80%): S$2,080,000

Downpayment (20%): S$520,000

Loan Tenure: 20 years

Interest Rate: 3.5% p.a.

Est Mortgage Payment: App S$12,000/m

Mixed-Use Shophouse

1st: Commercial

2nd: Residential

Freehold

Full Ownership

District 2

Everton Park/Tanjong Pagar/Telok Ayer

5–10 min walk to Outram Park / Tanjong Pagar / Telok Ayer MRT

~1,700 - 6500 sqft

Retail; take-away cafe, possible F&B with URA approval and proper renovation

Annual Rental Income: $174K - $262K

Rental Yield: 2.32% – 3.75%

Capital Appreciation: ✅ Strong (Freehold + central fringe)

Residential Option: ✅ Yes (Staffs can stay upstairs)

Foreign Ownership: ⚠️ Allowed [LDAU approval (rare)]

Manufacturing: ❌ Not permitted

Export: ❌ Not applicable

Foreign Workers: ❌ Limited under commercial zoning

Initial Outlay: High$6,980,000 - $7,500,000

Purchase Price: S$7,200,000 (average)

Loan (80%): S$5,760,000

Equity (20%): S$1,440,000

Loan Tenure: 20 years

Interest Rate: 3.5% p.a.

Est Mortgage Payment: App S$33,400/m

Commercial Shophouse

Both: Commercial

Freehold

Full Ownership

District 2

Everton Park/Tanjong Pagar/Telok Ayer

5–10 min walk to Outram Park / Tanjong Pagar / Telok Ayer MRT

~1,700 - 8000 sqft

Retail; take-away cafe, possible F&B with URA approval and proper renovation

Annual Rental Income: $160K - $225K

Rental Yield: 1.68% – 3.21%

Capital Appreciation: ✅ Strong (Freehold + central fringe)

Residential Option: ❌ No

Foreign Ownership: ✅ Allowed

Manufacturing: ❌ Not permitted

Export: ❌ Not applicable

Foreign Workers: ❌ Limited under commercial zoning

Initial Outlay: Highest$7,000,000 - $9,500,000

Purchase Price: S$8,250,000 (average)

Loan (80%): S$6,600,000

Equity (20%): S$1,650,000

Loan Tenure: 20 years

Interest Rate: 3.5% p.a.

Est Mortgage Payment: AppS$38,000/m

Business Expansion Proposal: Harrison Food

🔑 Executive Summary

This proposal recommends that Walnut Tree (Hondunamu), a growing Korean food business specializing in cakes and bento boxes, transition its main operations from Everton Park to Harrison Food, a freehold industrial development in Tai Seng. The goal: transform into a scalable, centralized food hub for B2B, B2C, and export operations.

✅ 1. Freehold Advantage: Own Your Future

Freehold tenure ensures permanent ownership and long-term capital appreciation.

No lease decay – retains value over time and increases borrowing power.

Gain equity from business premises rather than “burning” rental payments.

Harrison Food purchase price: S$3,336,245 – progressive payment eases cash flow.

📍 2. Strategic City-Fringe Location

7–10 mins drive from Everton Park.

Walkable to Tai Seng MRT (Circle Line).

Direct access to CTE, KPE, PIE – ideal for islandwide deliveries.

Close to key supply chains and F&B hubs.

Surrounded by industrial and commercial buildings = high footfall lunch crowd.

🏢 3. Purpose-Built for Scalable F&B Production

Designed for F&B: grease traps, exhaust ducting, high floor loading, cold room-ready.

High ceilings & modular space (~1,700 sqft) to combine:

R&D kitchen

Baking & meal prep lines

Packaging & cold storage

Centralize operations = faster output, lower overheads, stronger brand control.

🛠️ 4. Food-Use Ready & Compliant

URA Zoning: B1 Light Industrial (F&B approved)

Built to support:

NEA/SFA food licensing

Central kitchen workflows

Light production & automation (baking lines, mixers, etc.)

📈 5. Future-Proof Business Growth

Harrison Food enables transition from café/takeaway to:

Mass production (B2B supply)

Export to Malaysia, Indonesia

Cloud kitchen / frozen delivery model

Private-label and franchise expansion

This positions your brand to:

Supply supermarkets like Chorok Mart, Koryo Mart

Sell meal kits and bento packs islandwide via e-commerce

Scale with efficiency, ownership, and control

💰 6. Smart Financial Strategy

💸 Progressive Purchase Plan (24-Month Timeline)

Total Purchase Price: S$3,336,245

Loan (80%): S$2,668,996

Downpayment (20%): S$667,249

Interest Rate: 3.5% | Loan Tenure: 20 years

Monthly Mortgage: ~$15,500 (comparable to current rent)

🏗️ Total Investment Breakdown (over 2 years)

Acquisition: S$3.34M (progressive)

Renovation & fit-out: S$300K–$500K

Equipment (automation-ready): S$200K–$350K

Total: ~S$4.1M (phased, supported by grants)

📈 24-Month Revenue Growth Plan

Year 1 Revenue: ~S$900K | Profit Margin: ~8–10% (setup year)

Year 2 Revenue: ~S$1.5M–$2M | Profit Margin: ~25–30%

Potential to scale further with new delivery models, exports, and franchises

💹 ROI & Payback Estimate

Payback Period: ~7–8 years (incl. appreciation + profit)

Strong long-term gains through ownership + brand growth + export potential

🎁 7. Government Support Options

Enterprise Singapore: Support for export & automation

Productivity Solutions Grant (PSG): Up to 70% subsidy on eligible systems

EDG (Enterprise Development Grant): For branding, equipment, and expansion strategy

NEA / SFA Grant Eligibility: For central kitchens and food safety systems

🔍 8. Why Not Rent? Real Numbers

Current Everton Park Setup

Rental (monthly): Approximately S$15,000 paid to landlord

Ownership: None — zero equity or asset retained

Future Value: Zero — no return when lease ends

Expansion Room: Limited — constrained by layout and mixed-use zoning

Harrison Food Ownership

Rental redirected into mortgage: Build equity in a freehold asset

Ownership: Full ownership with long-term value

Future Value: Retain and potentially resell at a profit

Expansion Room: Modular and purpose-built — easily scalable for future needs

🚀 9. Business Case Summary

🔎 Key Features of Harrison Food

Tenure: Freehold — enjoy perpetual ownership with no lease decay.

Zoning: B1 Industrial — approved for F&B production, ideal for central kitchens and food processing.

Location: Strategically located at Tai Seng / Upper Paya Lebar (District 13).

Ownership: 100% full ownership — invest in a physical asset with resale value.

MRT Accessibility: Just a short walk to Tai Seng MRT Station, ensuring ease of access for staff and logistics.

F&B Ready: Purpose-built with high ceilings, exhaust ducts, and grease trap provisions — plug and play for food businesses.

Residential Component: Not included — optimized solely for efficient and scalable food production.

Foreign Worker Quota: Easier to employ foreign workers under the industrial property category.

Export-Ready: Infrastructure and zoning support future plans for regional export.

Long-Term ROI: Strong potential for capital appreciation and business expansion.

Footfall: Located in a dense industrial-commercial hub — surrounded by 9–5 crowd perfect for lunch traffic.

Cost Efficiency: Avoid escalating rental; monthly payments go toward asset ownership.

Use of Grants: Eligible for multiple government grants to offset automation, tech, and export-related costs.

✅ 10. Strategic Recommendation

Proceed with securing unit at Harrison Food.

Phase renovation & production setup across 24 months.

Retain a small presence (takeaway + branding) at Everton Park if desired.

Use Tai Seng for high-volume, B2B, delivery, and export production.

Apply for government grants early to ease cash flow.

Launch multi-channel distribution by Year 2.

📝 Harrison Food = long-term ownership + scalable infrastructure + future-ready business model.

🏢 Buying Options for Harrison Food (Freehold Food Factory)

1. Sole Ownership (Single Buyer Purchase)

Structure: Individual or single-entity ownership

Description:

The buyer acquires 100% ownership of the property under their personal name or through a wholly-owned private limited company.

Full control over business decisions, property usage, and exit strategies.

All profits from appreciation, rental, and business operations go solely to the owner.

Pros:

Complete autonomy

Full entitlement to future gains

Streamlined decision-making

Considerations:

Higher initial capital outlay

Full liability for mortgage, operating expenses, and capital investments

2. Joint Ownership / Investment Partnership

Structure: Co-ownership via a Joint Venture (JV) or Special Purpose Vehicle (SPV)

Description:

Two or more parties pool resources to acquire and operate the property.

Ownership can be structured through a private limited company, with shareholding based on capital contribution.

Responsibilities, returns, and liabilities are shared as agreed in a shareholder agreement.

Pros:

Reduced capital outlay per party

Shared risk and responsibilities

Access to broader expertise and resources (e.g., one party handles operations, another handles financing or export)

Considerations:

Requires clear legal agreements (e.g., joint venture contract, shareholders’ agreement)

Decisions must be made jointly—requires aligned vision and good communication

Future exit must be pre-agreed (e.g., share buyout, sale of asset, dissolution terms)

💼 Business Exit Options

When the time comes to scale down or exit, owning a freehold food factory at Harrison Food gives you multiple strategic exit paths — each with financial upside and flexibility.

🔁 Option 1: Sell the Food Factory with the Business

🔼 Estimated Capital Appreciation of Food Factory

(Freehold industrial properties in Singapore, especially niche-use food factories, have historically appreciated 2.5%–4.5% per annum depending on demand, location, and market cycles.)

Purchase Price: S$3,336,245

📈 Projected Capital Appreciation of Harrison Food (Freehold Unit)

Over a 10-Year Horizon:

Conservative Growth (2.5% p.a.): ~S$4.28 million

Moderate Growth (3.5% p.a.): ~S$4.78 million

Aggressive Growth (4.5% p.a.): ~S$5.36 million

Over a 15-Year Horizon:

Conservative Growth (2.5% p.a.): ~S$4.85 million

Moderate Growth (3.5% p.a.): ~S$5.69 million

Aggressive Growth (4.5% p.a.): ~S$6.79 million

💰 Projected Sale Range (Food Factory Only):

S$4,280,000 – S$6,790,000

(Dependent on brand strength, customer base, operational assets, IP, and equipment)

Estimated Sale of Business

🍱 Projected Business Sale Value: Korean Cake & Bento Business

[If the brand grows steadily, scales its B2B/export presence, and maintains profitability, we can estimate using a standard EBITDA or net profit multiple (typically 3x–5x for F&B SMEs).]

📌 Assumptions:

Annual Net Profit by Year 10–15: ~S$300K–S$500K (realistic for central kitchen + multi-channel sales)

Valuation Multiple: 3x to 5x (conservative to optimistic range)

💰 Projected Business Sale Value:

S$900,000 – S$2,500,000

(based on performance, brand recognition, operational systems, and export readiness)

🧮 Combined Potential Exit Value (Property + Business):

S$5.18M – S$9.29M

This projection highlights the transformational wealth potential of owning and operating your business from a freehold, purpose-built facility, rather than renting.

✅ Pros:

-Immediate Capital Realization: Unlock potentially significant capital gains from both business goodwill and property appreciation.

- Attractive Package: A turnkey, licensed, and operational food business with real estate attached is highly appealing to investors or international buyers looking for market entry.

- Business Legacy Continues: The new owner can take over seamlessly with trained staff, established systems, and clientele.

⚠️ Cons:

- Loss of Future Income Stream: Giving up steady recurring profits and passive income.

- Time to Find Right Buyer: May take time to identify buyers aligned with your valuation and terms.

💡 Suggestions:

- Package IP, recipes, brand rights, digital presence, and customer base to raise valuation.

- Work with a business broker or M&A advisor familiar with F&B exits.

- Time sale when profitability is high and property market trends upward.

🏠 Option 2: Continue Renting Out the Property & Retain Ownership

- Monthly Rental Income Estimate: S$12,000 – S$15,000/month

(Depending on market demand, fittings, and licensing transfer)

✅ Pros:

- Steady Passive Income: Long-term monthly rental returns with rising demand for licensed food factories.

- Capital Preservation: Hold onto a rare freehold food asset while benefiting from potential future appreciation.

- Minimal Operational Burden: Assign property to a management agent and collect rent passively.

⚠️ Cons:

- Ongoing Responsibilities: Some oversight required for tenancy, maintenance, and renewals.

- Market Exposure: Rental rates and property values may fluctuate based on economic conditions.

💡 Suggestions:

- Convert to triple-net lease (tenant pays maintenance, insurance, and property tax) to minimize landlord duties.

- Reinvest rental income into other ventures, family trust, or retirement planning.

- If market peaks, consider selling later for higher returns.

🔄 Option 3: Exit from Operations Only, Retain Property for Future Repurposing

- Convert business into a brand/IP-only model — license your recipes or franchise the concept.

- Lease factory to another operator while retaining the brand.

✅ Pros:

- Maintain brand legacy and generate royalties/licensing income.

- Retain property as an appreciating asset or pass it down for next-gen succession.

Final Thought

Owning the food factory gives you control — not just over your operations, but also your exit strategy. Unlike renting, which ends with zero returns, ownership allows you to choose the right timing, price, and path to exit with dignity and wealth preservation.

DISCLAIMER

While Huttons Asia Pte Ltd (L3008899K) has made every effort to ensure the accuracy and timeliness of the information and materials contained herein, it does not guarantee the completeness, accuracy, or suitability of the information for any particular purpose. The information provided is "as is," without any warranty or representation of any kind, either express or implied.

Huttons Asia Pte Ltd (L3008899K) and/or its agents shall not be liable for any errors, omissions, or inaccuracies in the information or for any damages arising from the use of or reliance on this information, whether direct, indirect, consequential, or otherwise. Any decision made or action taken based on the information in this presentation or document is done at the user's own risk.

Huttons Asia Pte Ltd (L3008899K) and its agents disclaim any responsibility for any legal claims or disputes arising from the use of the provided information. It is the responsibility of the user to verify the accuracy and appropriateness of the information before making any decisions or taking any actions. Users are advised to consult with legal, financial, or other relevant professionals before making any decisions.